Uncovering the Potential: Investing in Australia Florins - A Hidden Gem?

- Charlie Tripodis

- Jan 27, 2025

- 3 min read

In today's investment landscape filled with choices, many options often go unnoticed. One of these is the Australia Florin. With its captivating history and unique characteristics, this currency might be the hidden treasure many investors are seeking. This article explores the potential of investing in Australia Florins, examining their significance, advantages, and why they are worth your consideration.

Understanding the Australia Florin

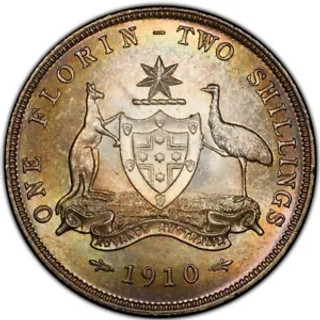

The Australia Florin has a significant history dating back to the 19th century. Minted when Australia was experiencing economic expansion (1910-1963), the Florin holds both historical and cultural significance.

One key advantage of the Florin is its silver content. These coins are primarily made from sterling silver, providing intrinsic value that serves as a hedge against inflation. For instance, as inflation rates reached over 5% in Australia in 2023, investors may look to silver coins for stability and value retention.

The limited availability of Australia Florins further enhances their appeal. Many Florins are no longer in circulation, making them increasingly rare. A notable example is the 1934 Australia Florin, of which only 800,000 were minted. This rarity can boost demand among collectors, subsequently driving up their market value.

The Investment Landscape

Investing in Australia Florins offers a unique opportunity for portfolio diversification. The market for precious metals and historical coins has generally shown positive growth trends. In fact, between 2010 and 2021, the value of silver increased by nearly 50%, reflecting this stable investment avenue.

Investors who are accustomed to stocks and bonds might see coins as an unconventional choice. Yet, the Florin offers both tangible and intangible benefits. Its rich heritage and the connections it forms with history enthusiasts make it a fascinating investment.

Online marketplaces and auction sites now make it easier than ever to buy Australia Florins. For example, platforms like eBay have hundreds of listings for these coins, allowing investors to connect with a global community for buying and selling opportunities.

Key Factors to Consider When Investing

Investing in Australia Florins can be rewarding, but a thoughtful approach is essential. Here are some key factors to keep in mind:

Condition and Authenticity: The coin's condition significantly impacts its value. Coins that are well-preserved can command prices up to 30% higher than those with visible wear. Always consider coins certified by reputable grading services for assurance of authenticity.

Market Trends: Staying informed about market trends is crucial for any investor. Silver prices can fluctuate based on economic indicators. For instance, a rise in inflation often leads to an increase in precious metal prices, making it a good time to invest.

Investors should also prioritize proper storage and maintenance of their coins. Using protective holders or cases helps preserve their quality and value. A well-maintained coin can see its value appreciate significantly over time—an excellent example is the 1910 Florin, which has a retail price of around AU $10,000 value in Gem condition today.

Networking with fellow collectors and attending related trade shows can also provide vital insights. Engaging with experts can lead to valuable tips and good deals that can enhance your investment strategy.

The Emotional Aspect of Collecting

Investing in Australia Florins transcends mere financial considerations; it offers a deeper connection to Australian history. Each coin tells a story and resonates with collectors on an emotional level.

For many collectors, the emotional bond to a coin can enhance its investment value. The joy of uncovering a rare find or adding to a collection creates a rich experience. This process can turn collecting into a fulfilling hobby, allowing investors to build connections with others who share their passion.

This blend of investment potential and personal passion means that Australia Florins aren’t just assets; they are part of a narrative filled with history.

Final Thoughts

Australia Florins present a compelling opportunity for those aiming to diversify their investments. With a combination of historical value, intrinsic worth, and strong emotional connections, these coins form an intriguing asset class.

Potential investors should balance careful research with their enthusiasm for history and craftsmanship. In times of market instability, the Australia Florin stands as a resilient option, potentially increasing wealth while linking investors to a rich historical narrative. Whether you are an experienced investor or new to numismatics, the Australia Florin may be the treasure you've been searching for.

Comments